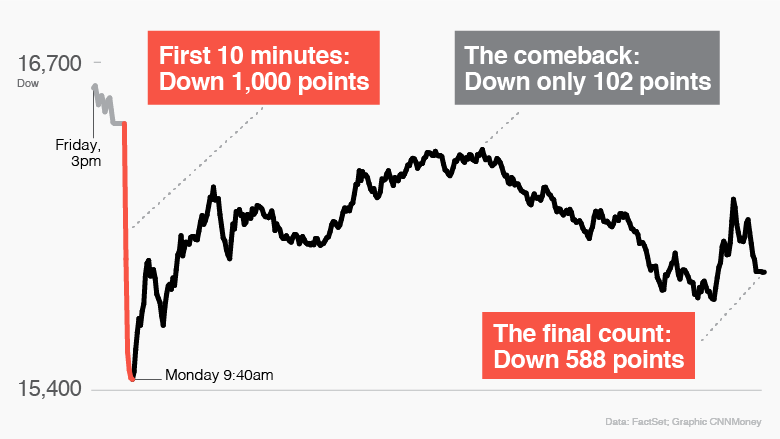

As everyone already knows, this past Monday was a pretty wild ride in

the market. After historic 1,000-point plunge, Dow dives 588 points at

close....the 588 decline was the worst since August of 2011. As a long term investor, we were definitely happy to see the correction we've been long awaiting. Sales were to be had throughout the market and our family went shopping!

By the time the day was over, we had 7 limit orders execute. In no particular order, below are the 7 companies that we bought on 8/24/2015:

- Enbridge Inc - 9 shares for $37.17/share

- Union Pacific Corp - 4 shares for $80.00/share

- Occidental Petroleum Corp - 5 shares for $64.08.share

- Kinder Morgan Inc - 12 shares for $29.00/share

- Johnson & Johnson - 4 shares for $90.00/share

- Oneok Partners LP - 12 shares for $28.09/share

- W. P. Carey Inc - 6 shares for $58.00/share.

We ended up spending a total of $2,380.01 on the 7 recent Black Monday buys. Our purchase will net an estimated average yield of 5.5% with our estimated forward dividends increasing by another $132.73, putting our yearly dividends at approximately $3,219/year (excluding our Edwards Jones account) and $3,576/year (including our Edward Jones account).

Of our buys, six out of the seven buys were companies that we had already owned. We did, however manage to pick up shares of W.P. Carey Inc to add yet another dividend paying stock to our family's dividend stocks portfolios (WF and EJ Accounts). Our portfolio now stands at a total of 47 different dividend paying stocks/ETFs and also 4 companies that either don't pay a dividend our has currently suspended their dividends.

Our family's dividend stocks portfolio may be found

by clicking on the link below:

We also maintain an extensive list of stock analysis

that can be access through the link below:

We also just started a list of Recent Buys by other bloggers

that can be access through the link below: